Success story #12: Alexandru Ivan – how a designer began creating tools for traders

After changing careers, Alexandru turned trading into his main income and began publishing the tools he built for his own use on the cTrader Store, generating around $900 in sales over several weeks.

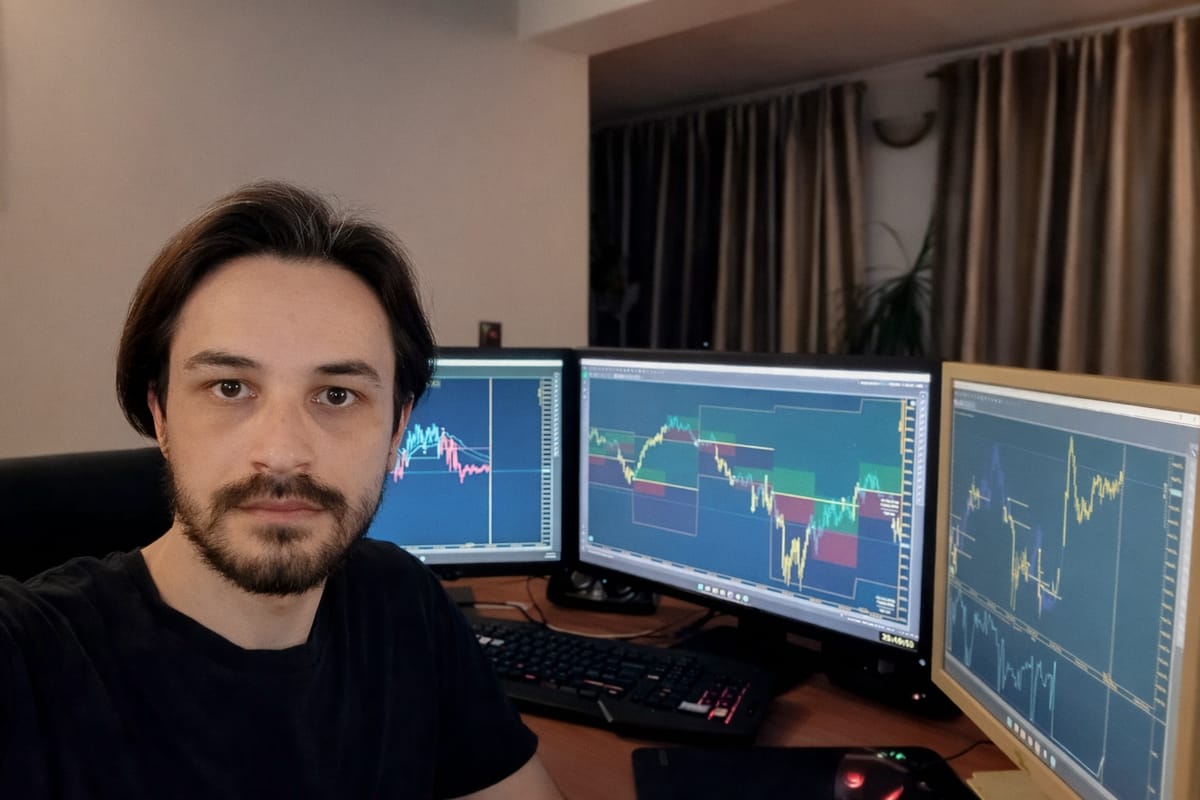

Alexandru Ivan made a clear and risky decision to change his career and commit to trading as a full time job. After working as a designer, he chose to leave that field behind and rely entirely on trading as his main source of income. Over time, trading became his primary way of supporting himself, and the tools he later built for his own use turned into products for other traders as well. Since he began sharing them publicly, these tools have generated around $900 in cTrader Store sales over several weeks. They reflect a practical approach grounded in real trading needs rather than marketing promises.

Choosing risk over comfort

Alexandru Ivan is known on the cTrader Store under the name wasted.talend. He is 36 years old and lives in Romania. His professional background is in graphic design, a field he learned on his own through experimentation and small projects. This early experience led to freelancing, where he expanded into other areas of graphic design and coding. While design remains important to him, trading gradually became his main focus.

He started trading in his late twenties, beginning with crypto. The learning curve was much steeper than in design, and he quickly realized he had to make a choice between focusing on trading or returning to his design career.

“Replacing my regular job with trading income, and learning to develop trading systems, skills that fundamentally changed how I think about markets.”

He committed to trading and approached it the same way he once approached design, by learning through practice. This time, that meant studying trading algorithms and teaching himself to code tools that could support his own work. The name “wasted.talend” comes from that period of transition, when it felt like one path was being given up for something uncertain. Looking back, he sees that nothing was wasted.

Trading with cTrader

Discovering cTrader marked a turning point. He was drawn to the platform’s clean interface, fast execution, non-time-based charts, and the flexibility of cAlgo. Clear documentation and practical examples made development easier, and about a year ago he fully switched to cTrader, moving all of his algorithmic work onto the platform.

When he noticed a lack of practical execution tools, he decided to publish a cBot he had originally built for himself. The first sale came unexpectedly and encouraged him to refine the tool and share others he already relied on in his daily trading. Going public turned out to be more valuable than he initially expected, as feedback and suggestions from users began to directly shape further updates.

“Transparency is important to me. Getting a tool should not be just a transaction. It should come with a clear understanding of how to use it effectively. When someone reaches out, I take the time to explain the logic, the parameters, and how the tool can be adapted to their trading style. Some of these conversations even turned into friendships.”

Inspired by Alexandru’s story?

Join the creators shaping the future of trading on cTrader Store.

Featured products

Alexandru highlights 4 core tools that share the same idea. Instead of trying to predict the market or generate buy and sell signals, they help traders better understand what is happening right now. Each tool highlights moments when market behavior changes, such as unusual price moves, shifts in momentum, real price structure, or imbalances between buyers and sellers.

WT - PjER (Price Jump) Indicator

An indicator that analyzes historical price movements to define typical volatility and build confidence bands representing the expected price range. Designed to adapt across different market regimes and volatility conditions.

WT - Amplitude – Momentum Detection

A real-time regime detection indicator focused on identifying momentum phase changes through price displacement and reversal strength. The tool adjusts dynamically to market behavior and is based on academically grounded concepts.

WT - Custom Renko PRO

A Renko solution that processes full intra-bar tick data to construct bricks based on actual price movement. It offers extensive customization for different bar types and visual preferences.

WT - Tick Imbalance Bars

A market microstructure tool built on academic research, sampling price by information flow rather than time or volume. It highlights moments when buying or selling pressure exceeds expected levels, helping identify shifts in participation before equilibrium is reached.

Alexandru develops and publishes cBots that grow directly out of his own trading practice. Each tool is tested in live trading and refined through detailed record-keeping rather than built around marketing promises. His approach avoids flashy naming and exaggerated claims, focusing instead on clarity, robustness, and practical use.

“My tools avoid hype, are tested in my live trading, and will continue to evolve as long as I use them. I’m always open to questions and happy to guide anyone who wants to understand how to use them effectively.”

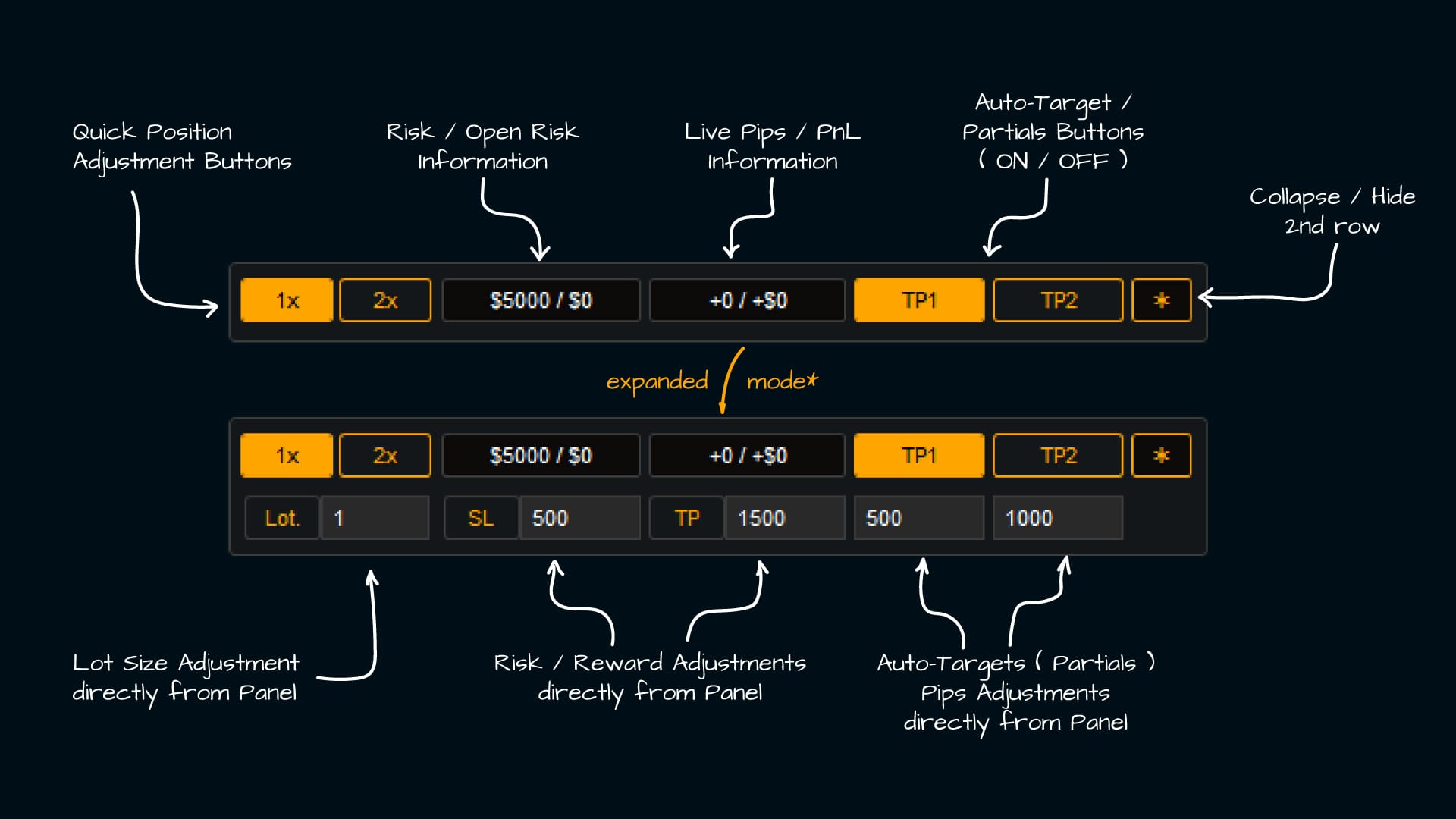

WT - Hotkeys - Trade Panel

WT - Hotkeys - Trade Panel is designed for fast and precise trade execution, where speed and control are critical. It is built for active trading on lower timeframes and replaces manual clicking with keyboard-based execution, allowing actions to be taken instantly as market conditions change.

“As I trade on lower timeframes, having such a tool is very important. Seconds matter, and manual clicking simply isn’t fast enough when opportunities appear and disappear in seconds.”

Key features:

• Trades can be opened, closed, and managed instantly using keyboard hotkeys

• Planned risk, active risk, and current P&L are shown in real time during execution

• Position size switches between 1x and 2x with clear risk visibility before entry

• A compact panel displays only essential information without blocking the chart

• Positions can be reversed, scaled, or partially closed using hotkeys

• Hotkeys, panel layout, and risk settings are fully customizable

The bot delivers exactly what it is designed for: fast, clean, and reliable trade execution. Traders highlight its practical value in everyday manual trading, especially when speed and precision matter most:

“WT - Hotkeys - Trade Panel works as promised: quick buy/sell, SL/TP set, modify and close orders with keystrokes or UI. It’s a reliable GUI tool for manual traders who value speed and precision. If you trade manually, this panel makes your workflow smoother and safer.”

Sharing experience

Drawing on his experience as both a trader and a developer, Alexandru shares a few practical observations shaped by real work. He sees trading as a high-responsibility field where consistency and risk control matter more than speed, and notes that his own progress began once he moved away from over-leverage.

As a developer, he values simple ideas built step by step, often inspired by less obvious sources such as academic research, and treats AI as a support tool rather than a replacement for human judgment.

Final thoughts

Alexandru’s trading combines a discretionary element with a set of custom tools developed through real market experience. Over time, this approach has delivered stable results, reflected in the practical adoption of these tools, which have generated around $900 in cTrader Store sales over several weeks.

What carried me forward is curiosity, perseverance, humility, and detailed record-keeping. For me, every release is more than a product. It’s part of the journey that took me from design to trading and development.

Inspired by Alexandru’s story?

Join the creators shaping the future of trading on cTrader Store.

Comments ()